Despite a month of heavy spending, including some large upfront purchases (e.g. paying my annual private health insurance premium upfront), I was able to increase my net worth by almost $8k due to working some extra days during the Christmas break. As a contractor, every day you don’t work you don’t get paid. So I elected to work right up to Christmas, including the Christmas Eve Monday. As a result, my paychecks in January were larger than usual, offsetting the high spend.

Some key achievements this month:

1. Closed my Interactive Brokers CFD trading account. No more short term margin trading for me.

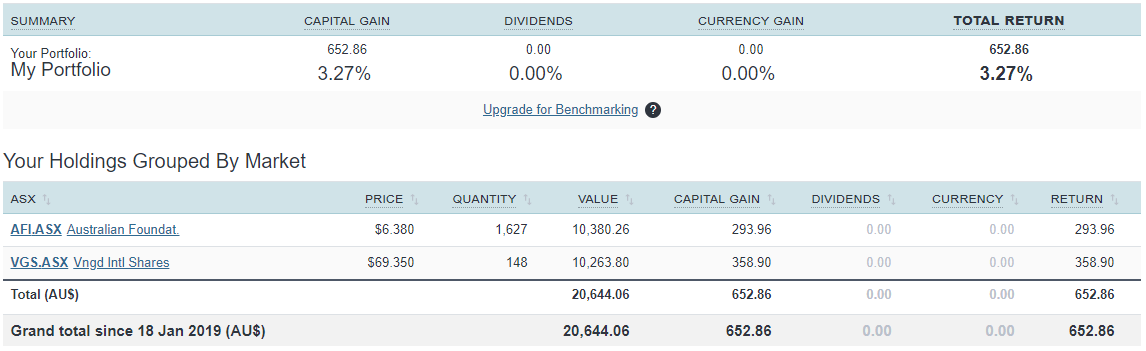

2. Opened a SelfWealth account and bought $10k of $AFI and $10k of $VGS (I used your referral code Dave from SMA).

3. Continued to sell down the crypto portfolio, cashing out another $5k worth.

4. Optimised some of my bills, resulting in projected annual savings of $1,451.

Bill optimisation

Private Health Insurance

Switched my private health insurance from Aus Unity Silver Extras ($166/month) to Bupa Bronze Extras ($110/month, or $1320/year). The only thing I use extras for is dental, so I can still do my bi-annual check up with Bupa at a no-gap provider.

Annual saving = $672

Public Transport

Started buying a Myki Pass ($5.30/day), instead of using Myki Money ($8.70/day).

A 33 day (25 business days) Myki Pass cost me $175.

Using Myki Money for that same period would be $8.70 * 25 = $217.50

That’s a saving of $1.70 per business day, and I work on average 230 business days per year.

Annual saving = $391

Internet

Even though I’ve moved out of home for almost 4 years now, I still pay for my mum’s internet bill. It’s been on direct debit and it’s just something I’ve always done, perhaps as a thank you for her paying for such expensive internet when I was growing up. I still remember when ADSL1 first came out, she was paying $90/month for the 1.5mbps plan which was the fastest speed available at the time. But man was I the coolest kid when everyone else had 56k dial-up.

She was on an old Optus cable plan paying $60/month for unlimited data. However she barely uses much data, maybe 100gb per month at most. So I found the perfect Optus mobile internet plan for her on OzBargain.

It was a Optus mobile SIM only plan, and for $60/month on a 24 month contract ($1440 over 2 years) you get:

1. 200gb of data per month

2. A Samsung Galaxy Tab S4

3. 12 months’ worth of Netflix subscription

I sold the Samsung tablet on Gumtree for $800, and I added the Netflix credit to my account ($168 worth). I did have to buy her a mobile broadband modem outright though (for $192), so it works out to be:

(Plan cost + modem) – (selling tablet + value of Netflix credit)

($1440 + $192) – ($800 + $168) = $664

$664 / 24 months = $27.67/month

Annual saving = $388

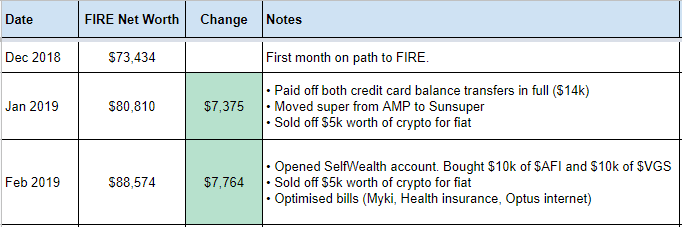

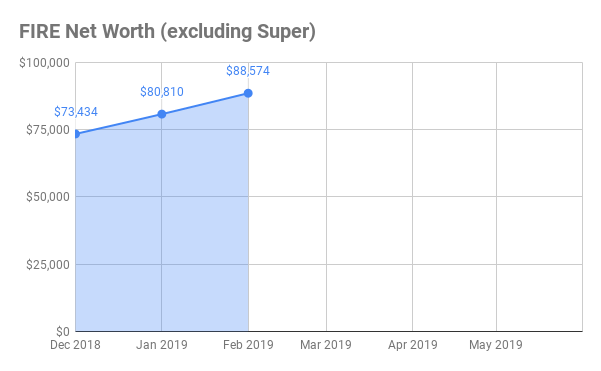

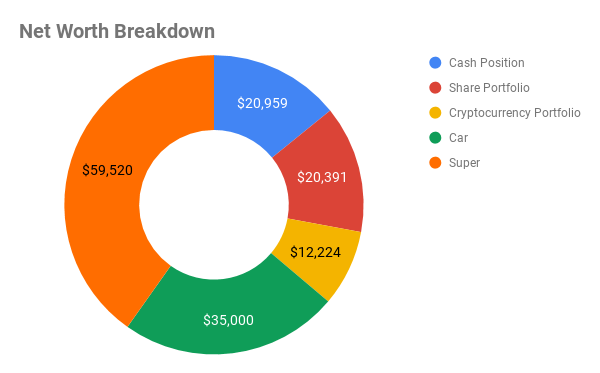

Here are the usual numbers and pretty graphs.

Net Worth Tracker

Thanks again for reading! See you next month.

Hey mate I am essentially at the same spot as you in terms of net worth!

Unfortunately, I am about to take a 10K hit this month with the family relocating to Darwin from Melbourne and then visiting family overseas!

Tough rough to FIRE ha ha.

Look forward to collectively working together and keeping in touch.

Cheers

The Incompetent Investor

LikeLike

Thanks for the support mate. It really does give me some motivation knowing at least somebody is reading these posts. Like I said in my other comment reply, I’ve actually been reading and subscribed to your blog for a while now. I just never really commented, which is something I’m sure to do going forward.

Those 10k relocation costs might put a temporary dent in your NW figure, but I’m sure it’ll be worth every cent to be with your family. Also enjoy the trip overseas!

LikeLike

That is all good. That what is all about. A collective effort to a better quality of life!

That is great, I had no idea. I need to shift it over to wordpress, because blogger.com is peeing me off :). But that is awesome to know you are subbed.

Looking forward to your next post dude!

Keep up the good work!

PS, I am not including super in my Networth, perhaps I should moving forward?

Chers

LikeLike

I get why you would add your car to your net worth – Do you use some sort of online market valuation tool?

Not sure of your situation, however you could downsize the car to minimise depreciation and put that extra money to WORK

Cheers

LikeLike

Hi Mateo,

I don’t really use any valuation tools such as Redbook. I find they’re not terrible accurate. Instead, I’ll have a rough idea of the market price by browsing similar cars (in a similar condition, with similar options) within my area on Carsales. I’ll also value it quite conservatively, as I believe you should value it at a price it could sell for quickly if you needed cash urgently.

I touched on this point in my Jan 2019 update:

“Some say you should not consider your car as an asset, as it doesn’t generate any income. My contrary view is that it should be part of your net worth figure, as long as you value it at a conservative price which it could sell for quickly. The market value of my car is closer to the mid $40k range (and insured at an agreed value of $50k), however if I needed cash urgently I could offload it for $35k quite quickly.”

And yes, I am really considering selling the car and putting the funds toward more LICs/ETFs instead!

LikeLike

Nice update! You monthly change in net worth is pretty impressive. Can’t wait to see next months update. Great stuff. I’ve been posting about my spending each month but think I need to change to a post about net worth instead.

LikeLike

Thanks mate. Just checked out your site – impressive stuff! Love the clean layout. Going through a few of the articles now.

Regarding tracking spending vs. net worth, I think that’s a personal preference.

I think the more important thing is you have a clear FI related goal ($100k+ portfolio by Dec 2019) that you’re tracking against.

All the best!

LikeLike